$40 billion worth of crypto crime enabled by stablecoins since 2022

Anjali Nair; Getty Images

Stablecoins, cryptocurrencies pegged to a stable value like the US dollar, were created with the promise of bringing the frictionless, border-crossing fluidity of bitcoin to a form of digital money with far less volatility. That combination has proved to be wildly popular, rocketing the total value of stablecoin transactions since 2022 past even that of Bitcoin itself.

It turns out, however, that as stablecoins have become popular among legitimate users over the past two years, they were even more popular among a different kind of user: those exploiting them for billions of dollars of international sanctions evasion and scams.

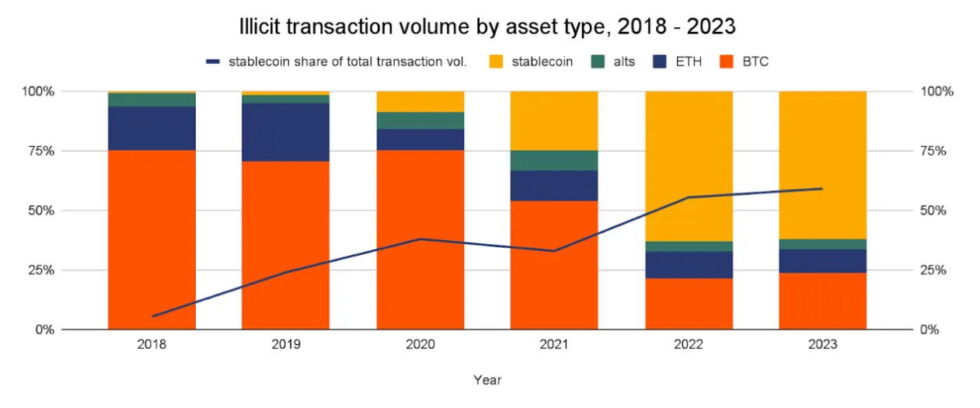

As part of its annual crime report, cryptocurrency-tracing firm Chainalysis today released new numbers on the disproportionate use of stablecoins for both of those massive categories of illicit crypto transactions over the last year. By analyzing blockchains, Chainalysis determined that stablecoins were used in fully 70 percent of crypto scam transactions in 2023, 83 percent of crypto payments to sanctioned countries like Iran and Russia, and 84 percent of crypto payments to specifically sanctioned individuals and companies. Those numbers far outstrip stablecoins’ growing overall use—including for legitimate purposes—which accounted for 59 percent of all cryptocurrency transaction volume in 2023.

In total, Chainalysis measured $40 billion in illicit stablecoin transactions in 2022 and 2023 combined. The largest single category of that stablecoin-enabled crime was sanctions evasion. In fact, across all cryptocurrencies, sanctions evasion accounted for more than half of the $24.2 billion in criminal transactions Chainalysis observed in 2023, with stablecoins representing the vast majority of those transactions.

The attraction of stablecoins for both sanctioned people and countries, argues Andrew Fierman, Chainalysis’ head of sanctions strategy, is that it allows targets of sanctions to circumvent any attempt to deny them a stable currency like the US dollar. “Whether it’s an individual located in Iran or a bad guy trying to launder money—either way, there’s a benefit to the stability of the US dollar that people are looking to obtain,” Fierman says. “If you’re in a jurisdiction where you don’t have access to the US dollar due to sanctions, stablecoins become an interesting play.”

As examples, Fierman points to Nobitex, the largest cryptocurrency exchange operating in the sanctioned country of Iran, as well as Garantex, a notorious exchange based in Russia that has been specifically sanctioned for its widespread criminal use. Stablecoin usage on Nobitex outstrips bitcoin by a 9:1 ratio, and on Garantex by a 5:1 ratio, Chainalysis found. That’s a stark difference from the roughly 1:1 ratio between stablecoins and bitcoins on a few nonsanctioned mainstream exchanges that Chainalysis checked for comparison.

Chainanalysis

Source link